Recent research has shown that 2/3 of Vancouverites are comfortable with new, mixed use, mixed-income, multi-family developments.

A combination of community housing trusts, land trusts, non-profit housing development corporations, social housing providers and workplace housing initiatives will benefit from single source, below market funding and a shared logistical/financial set of tools and procedures to scale approaches to ‘Building Solutions to the Housing Crisis’.

Affordable Rental and Affordable Homeownership

A key principle for affordable housing development is that a primary focus be on affordable rental (CMHC defines affordable as costing less than 30% of a household’s gross, pre‐tax income ) but projects can include deep rental subsidy, near-market, and market rental as well as market sales as part of the mix. A key concept includes affordable homeownership (AHO) achieved through a covenant on the property where if someone purchases a home at a discounted rate (i.e. 35-50% below market) they have to sell it at the same discounted rate.

Secondary Housing Market (Non-Profit Housing Developers)

Private developers typically make between 16% and 20% on development costs.. The market therefore needs a new kind of developer—a Non-Profit Housing Development Corporation (NPHDC)—to help create a secondary housing market. By removing profit from the equation, NPHDCs can significantly reduce overall costs through lower Development Cost Charges (DCCs) and permit fees, negotiated fee reductions from professionals (such as architects and engineers), and carefully managed contracts with constructors and sub-trades for both materials and labour. Marketing expenses can also be minimized thanks to the strong appeal of affordable housing.

Moreover, affordable housing projects are often eligible for substantial density bonuses that translate into more affordable units. This positions NPHDs to play a pivotal role in addressing housing needs and ensuring that homes remain financially accessible for a broader range of individuals and families.

Land Trusts and Perpetual Covenants

In developments where the land can be provided at no cost, housing affordability can be significantly increased. Land trusts and perpetual covenants on deeds ensure that this affordability extends to future generations by keeping the difference between the market price and the discounted price with a trust or covenant holder. This approach offers a true market solution for low to moderate-income earners, allowing them to enter an otherwise overheated housing market and build equity. This is distinct from social housing, as the units themselves remain part of the market, with the land or discount portion held separately to maintain affordability.

Workplace Housing and Co-development

Businesses in BC are struggling to attract and retain talent because housing prices in Metro Vancouver are simply too high. One solution is for Non-Profit Housing Development Corporations to partner with companies whose management and staff need affordable housing. Possible options include affordable rental units and covenanted affordable homeownership.

Older strip malls also present a promising opportunity for new community developments that provide affordable housing. By revitalizing these properties, businesses can benefit from innovative tax strategies that offset capital gains exposure when a portion of the land is donated to an affordable housing provider. This approach not only stimulates economic growth but also addresses the urgent need for more accessible housing.

ADUs, Laneway Homes and Secondary Suites

BC Housing has introduced the Secondary Suites Incentive Program, offering homeowners a forgivable loan of $40,000 to build a secondary suite or laneway home. In return, homeowners must commit to renting the new unit at prescribed affordable rates for a minimum of five years. This approach helps create more affordable housing while also providing homeowners with an incentive to contribute to the rental market.

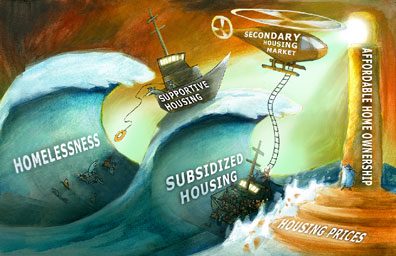

Housing Continuum

Canada’s social housing system is stagnant, with hundreds of thousands on waiting lists and demand far exceeding supply. When someone manages to secure a unit, they often remain there long-term because there are no viable alternatives. At the same time, only 7% of purpose-built rentals are affordable for the lowest income earners, while 54% of these earners are spending more than 30% of their income on rent.

To address these challenges, it is essential to build more purpose-built, affordable rental housing and to offer low- and moderate-income individuals and families the opportunity to enter the housing market and build equity. Encouraging affordable homeownership (AHO) can help create movement along the housing continuum. When a person transitions from a subsidized unit into an AHO property, that creates space for someone else to move up from the waiting list, or for someone in supportive housing to take a spot in subsidized housing. In turn, this opens a supportive housing unit for someone transitioning from temporary housing or homelessness.

Market Acceptance for New Housing Solutions

Canada is ready for innovative approaches to housing. A recent survey conducted by the Haskayne School of Business at the University of Calgary, on behalf of the Vancouver Native Housing Society, indicates strong support for mixed-use, multi-family, mixed-income developments in Metro Vancouver. Two-thirds of respondents expressed comfort with introducing new types of developments into their neighbourhoods, suggesting that there is a growing appetite for solutions that address housing affordability while fostering inclusive, diverse communities.

—